The new amendments to the Law have been designed to offer more legal certainty as regards securitisation undertakings subject to the supervision of the CSSF by incorporating the existing guidance from the CSSF in the Securitisation Law, as follows:

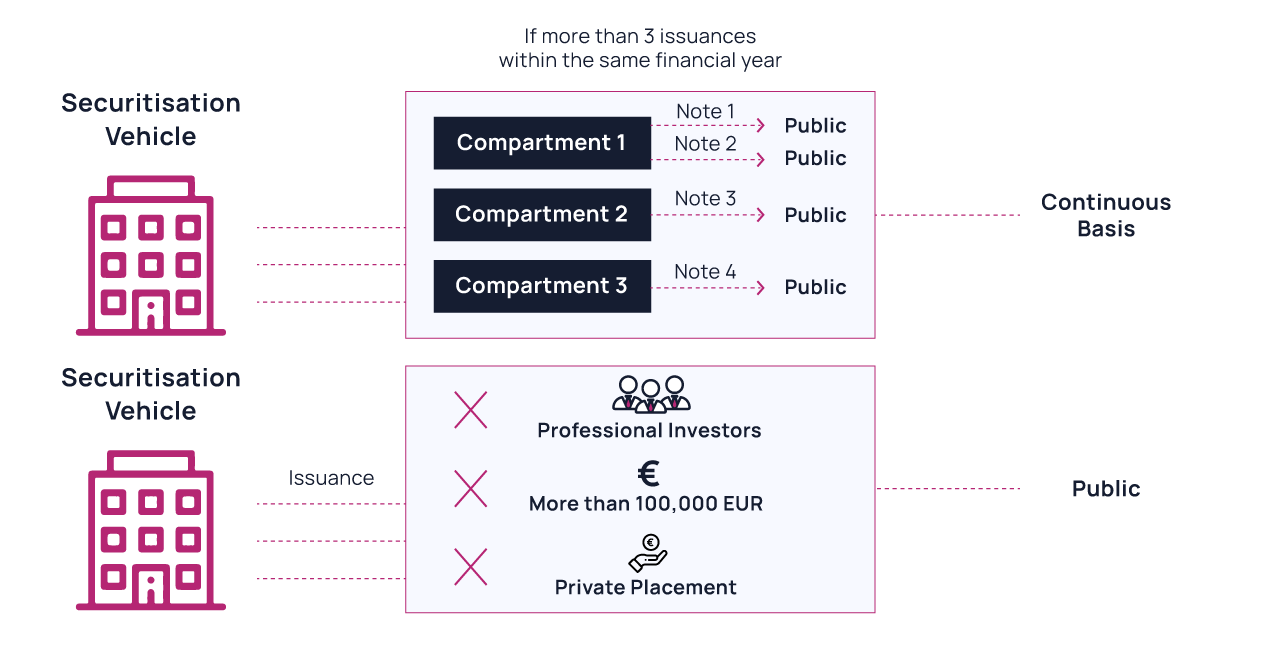

- In agreement with the existing CSSF guidelines, an issuance of financial instruments will be deemed to be made “on a continuous basis” if the securitisation undertaking makes more than 3 issuances of financial instruments to the public within the same financial period. The Law further confirms that the number of issuance should take into consideration all the compartments rather than on a compartment-by- compartment basis.

- An issuance of financial instruments will be considered to be made “to the public”, if all 3 of the following criteria are met:

- the issuance is not made to professional clients within the meaning of article 1(5) of the law of 5 April 1993 on the financial sector, as amended;

- the denomination of the financial instruments is less than EUR 100,000 (this amount is aligned to the Prospectus Regulation); and

- the issuance is not carried out by way of private placement (which must be assessed on a case-by-case basis according to the communication means and the technique used to distribute the financial instruments).

Find more about the securitisation process

by downloading our brochure